There is a lot to consider in configuring your system to use project accounting along with HR and Payroll. You want costs, as well as the billing on the project side, to all be accounted for. You also want, on the payroll side, the employees paid correctly and vacation and personal time properly accrued. (Bonus if it will also show “used time” on the employee attendance card!)

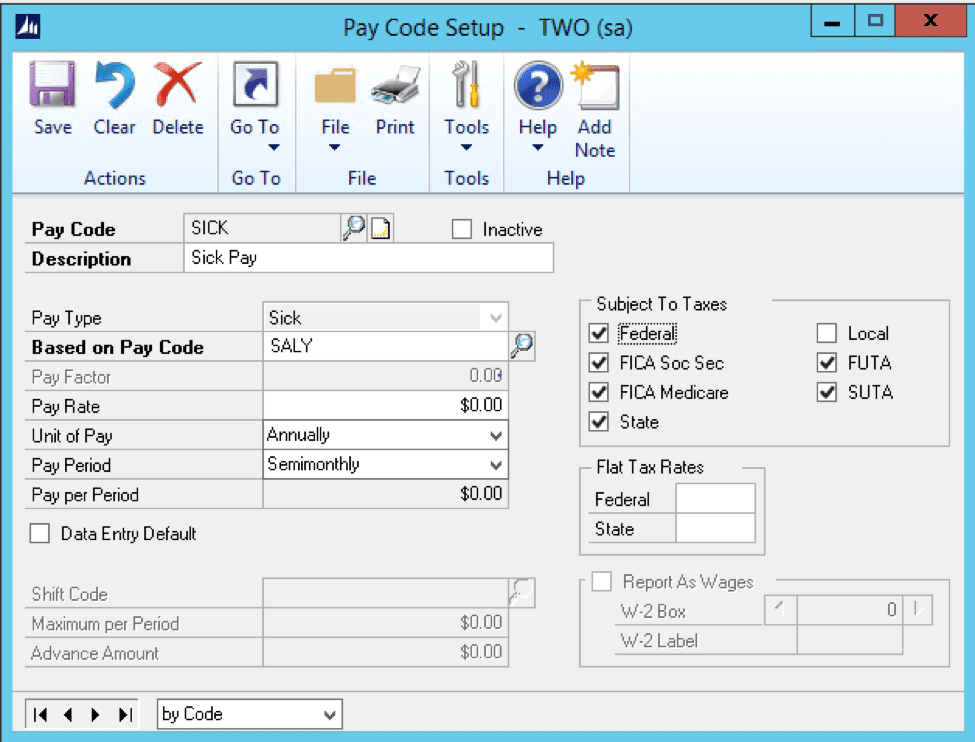

The first step is to set up the pay codes in payroll.

In payroll, you have pay codes, and with these, you have a pay type. When you are creating the pay codes to use any vacation or personal time, it needs a pay type such as vacation or sick leave for the time to go against an employee’s attendance card. All other pay codes with different pay types will not affect any attendance records for employees.

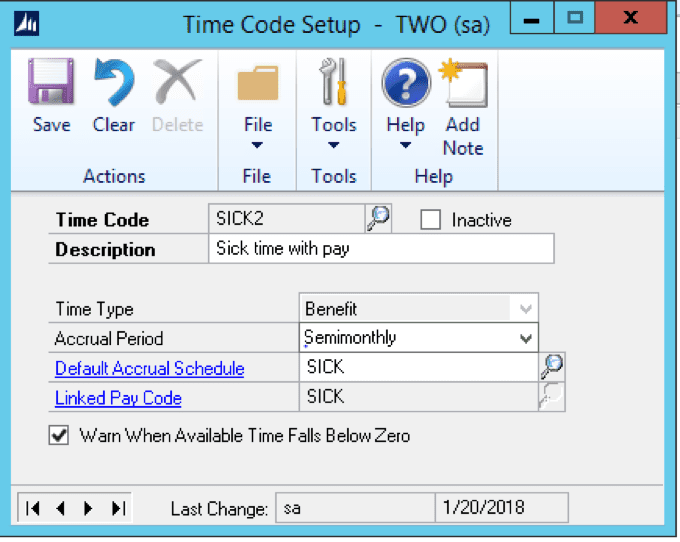

Next, you want to set up the vacation and sick codes in HR.

Once you have a pay code, you need to go into the attendance set up for HR and set up a time code for their accrual. You want to set up one for each vacation and sick pay type you have so that the accruals and time spent will be accurately accounted for.

Last Step is in the Project Accounting Module and cost categories.

Once you have your pay codes set up and assigned to employees, you will then need to go into the project and set up cost categories. Each cost category that is for a timesheet should have an hourly and/or salary pay code associated with it.

With this, when an employee is coding time to a project, and they select the cost category ‘SICK,’ there will be an entry in the HR attendance for this employee deducting ‘SICK’ time used.

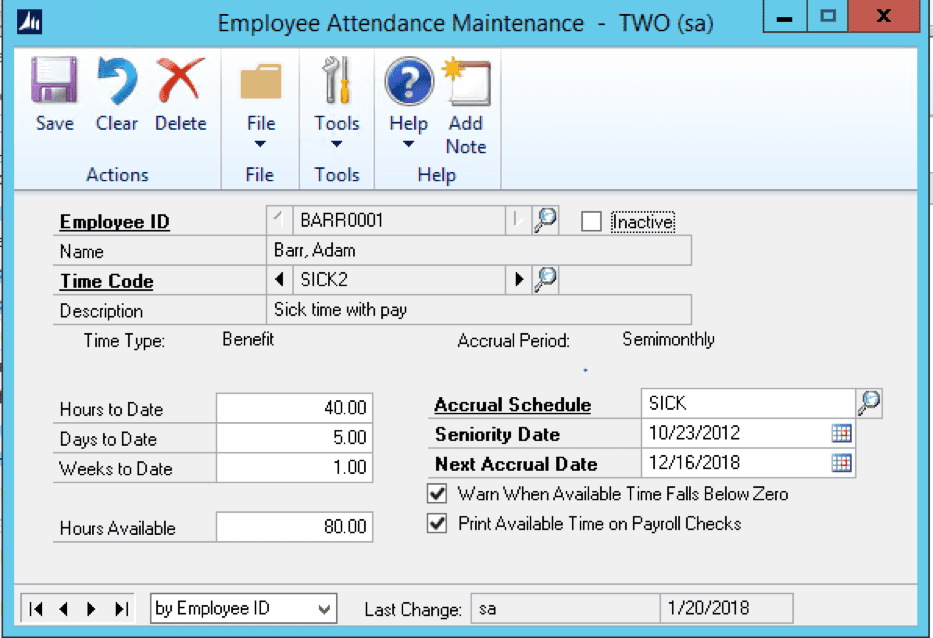

To see the employees time used and accrued you can verify it under HR/ Cards / Employee – Attendance / Maintenance

Select the employee ID and the Time Code

This window shows, by time code, what is available and the accrual schedule.

[avatar user=”CWilliams” size=”thumbnail” align=”left” /]COLLEEN WILLIAMS | COO/ Consultant Lead

Colleen graduated with a Bachelor of Science Degree in Accounting from California State University San Bernardino. She has extensive accounting experience over the past years working as a staff accountant and controller. Colleen has over 10 years Great Plains experience and over 6 years of working with BI360, which includes many implementations for public and private companies. She also has extensive experience with Business Intelligence, budgeting and report writing while working on BI360, QuickBooks, Oracle, PeopleSoft, Timberline and Solomon. Colleen has worked in various industries that include: real estate, property management, timeshare sales, publishing, and insurance. These various industries have given her the necessary experience to handle large company consolidations and report writing, budgeting and forecasting, project accounting, sales invoice processing, and fixed assets.